What is the Passenger Service Levy?

The Passenger Service Levy (PSL) is a fee per passenger service transaction that authorised taxi and booking service providers must pay. As of 1 July 2023, the Passenger Service Levy will increase to $1.20. The levy increase will fund the NSW Government’s industry adjustment assistance package of $905 million, designed to help taxi licence holders adjust to the new regulatory framework. The levy increase will remain in place until 31 December 2030, unless the full amount of the financial assistance funds are collected earlier.

How and when do I register as a taxpayer for the levy?

Authorised Taxi Service Providers and Booking Service Providers will need to register as a taxpayer through the Industry Portal on the Point to Point Transport Commission website to submit levy returns. Payment of the levy is a condition of authorisation. Authorised Service Providers must register as a taxpayer to pay the levy within seven days of becoming liable – this means within seven days of commencing passenger services.

Registration can only be done through the Industry Portal. You will need to provide:

- a direct debit authorisation that will allow Revenue NSW to make deductions from your nominated bank account

- an estimate of the number of passenger service transactions that you expect to carry out during the next 12 months

- details of a person who can be contacted about the levy.

NOTE: If you have not already provided us with 100 points of certified identification, you will need to upload it in the Industry Portal before you can register for the levy.

If you are providing taxi or booking services but are not registered as a taxpayer you are still obliged to pay the levy. If you do not complete a return, the Commissioner may issue you with an estimated assessment of your levy liability. See the Passenger Service Levy User Guide for more information.

Depending on the number of passenger service transactions to be conducted, an Authorised Service Provider may seek an exemption or rebate of the levy. More information is available from the fact sheet, Passenger Service Levy.

How is the levy calculated?

A levy of $1.20 applies to each passenger service transaction. If passed onto passengers, the levy will attract GST.

What is a passenger service transaction?

For Taxi Service Providers, it means $1.20 for every passenger service provided where a customer hails down a taxi in the street or takes a taxi from a taxi rank.

For Booking Service Providers, it means $1.20 for every booking for a taxi or hire vehicle which results in the provision of a passenger service.

What is not a passenger service transaction?

The levy is not payable if:

- a passenger service is not provided (e.g. the customer cancels the booking)

- the journey commences outside of NSW, or starts or finishes in a remote or very remote part of NSW as per the map below

- the service is provided under a community transport contract with Transport for NSW

- the service is for the transport of patients facilitated by a hospital or by or on behalf of Health Share NSW

- the service is provided in a bus (vehicles with more than 12 seats, including the driver)

- the service is in an ambulance

- the service is for transport under the Assisted School Travel Program of the NSW Department of Education

- the service is for transport of persons in custody by or on behalf of Corrective Services NSW

- the service is not otherwise captured by the legislation, such as a courtesy service or a carpooling arrangement.

Can I pass the levy on to passengers?

It is up to each service provider to decide whether to absorb the levy, or to pass it on to customers. If you choose to pass the levy onto customers (for example, as an addition to their fare), it will attract GST.

Transport for NSW has included the levy in its most recent taxi fares order to enable taxi service providers to pass on the cost of the levy to passengers.

Levy payments where the fare is not paid

If a trip is completed and the fare has not been paid (whether due to the passenger failing to pay or a credit card charge back due to a declined transaction), the passenger service levy is still payable on the trip.

Levy exemptions are only provided in these circumstances:

- Where the passenger service is not provided for any reason

- Where the transport begins in another state or territory

- Where another provider is already liable to pay the levy for taking a booking to provide the service.

Can I apply for an exemption?

There are a number of reasonable exemptions in place to help ease the burden on industry wherever possible. The levy is not payable if:

You can seek an exemption from the levy if:

- you are a small provider and carry out 150 or fewer passenger service transactions in any 12-month period,

- if you only provide taxi services or booking services within, commencing or finishing in a remote or very remote area of NSW.

Am I entitled to a rebate?

If you carry out more than 150 but not more than 600 passenger service transactions in any 12-month period you may apply for a rebate.

How do I apply for an exemption or rebate?

To apply for an exemption or a rebate:

- register as a taxpayer via the Industry Portal

- provide reasons why you believe you are entitled to an exemption or rebate and upload any supporting documents

If you are applying for a rebate you will also need to complete a direct debit authorisation which will permit Revenue NSW to make deductions from your nominated bank account.

What do I need to pay if I am entitled to a rebate?

If you apply for a rebate and this is accepted you will be required to pay the levy once a year.

For service providers who carry out more than 150 and not more than 400 passenger service transactions the annual levy payable will be $150.

For service providers carrying out more than 400 but not more than 600 passenger service transactions, the annual levy payable will be $400.

Passenger Service Levy exemptions and rebates: annual eligibility check

Service providers who have received an exemption or rebate from the Passenger Service Levy for any 12-month period need to check their ongoing eligibility annually.

The Commissioner emails these service providers annually about what they need to do.

If you received an exemption for any 12-month period and are still eligible for an exemption (due to the number of journeys or the remote nature of your service), no further action is required.

NB: The levy exemption also applies to passenger services that take place in, or start or end in a remote or very remote area of NSW.

I received an exemption from the levy for the last 12-month period, but my circumstances have now changed. What do I need to do?

You must update your taxpayer registration and update your annual passenger service transaction estimates through the levy section of the Industry Portal.

If you are carrying out between 151 and 600 passenger service transactions in any 12-month period you may be eligible for a rebate. You will need to update your annual estimates and your taxpayer registration via the portal, and provide supporting evidence of the number of passenger service transactions you carry out.

If you are carrying out more than 600 passenger service transactions in any 12-month period you need to update your annual estimates and your taxpayer registration via the portal, and will need to complete monthly levy returns.

Passenger services carried out in, to or from remote and very remote parts of NSW are exempt from the levy. If you are no longer carrying out passenger services in remote or very remote areas of the State, but are seeking an exemption or rebate based on the number of passenger service transactions you carry out, you may need to provide supporting evidence.

I received an exemption from the levy for the last 12-month period, and my circumstances have stayed the same. What do I need to do?

You will still need to submit a levy return for the previous 12 months. The Point to Point Transport Commissioner will use the information in the return to confirm ongoing eligibility for the rebate.

I received an exemption or rebate from the levy, but my circumstances have changed. What do I need to do?

If your circumstances have changed, once you submit your levy return, your eligibility for exemption or rebate will be checked and updated where necessary. This may mean that the size of the rebate you receive, or your exemption, will change.

For example, if you were initially eligible for a rebate in the 151-400 category, but have carried out more than 400 passenger service transactions, your return will reflect the higher number, and your eligibility for the rebate will be updated.

For example, if the number of passenger service transactions you carry out reduces from over 150 to fewer than 150, you should update your annual estimate and your taxpayer registration via the Industry Portal. You may be required to provide supporting evidence for the change. The changes will be assessed by the Commissioner and any exemption will be notified to you.

For example, as your business grows you may find that you are completing more than 600 passenger service transactions in any 12-month period, and therefore will need to change from rebate to monthly returns. Submit a levy return for the previous 12 months which will be assessed. You will then start to be able to report and pay your levy payment monthly.

You will need to update your annual estimates and your taxpayer registration via the portal and will need to submit a return every month from then on.

When do I need to lodge a return and there is no rebate applicable?

If you carry out more than 600 passenger service transactions in any 12-month period, then on or before the last day of each month, you will need to tell us how many passenger service transactions you carried out during the preceding month. Log into the Industry Portal and complete the Passenger Service Transactions Return. Download the Passenger Service Levy User Guide.

Log into the Industry Portal and complete the Passenger Service Transactions Return. Download the Passenger Service Levy User Guide.

What do i need to lodge a return and there is no rebate applicable?

If you carry out more than 600 passenger service transactions in any period of 12 months then on or before the last day of each month, you will need to tell us how many passenger service transactions you carried out during the preceding month. Log into the Industry Portal and complete the Passenger Service Transactions Return. Download the Passenger Service Levy User Guide.

What if I don’t lodge a return?

If you fail to provide details of the number of transactions carried out for an assessment period, the Point to Point Transport Commissioner will make an estimated assessment of your liability.

This will inform the value of the deduction from your nominated bank account.

If don’t provide details of the number of transactions carried out for an assessment period, the Point to Point Transport Commissioner will make an estimated assessment of your liability. This will inform the value of the deduction from your nominated bank account.

How do I know what to pay?

Monthly levy payments are calculated based on your return, or an estimated assessment. You will be issued with a Notice of Assessment telling you how much you need to pay.

Revenue NSW will deduct the levy from your nominated bank account on the 26th of each month (or the next business day if the 26th falls on a weekend or public holiday).

| Passenger Service Transactions per year | Amount payable $ |

|---|---|

| 1 - 150 passenger service transactions per year | $0 |

| 151 - 400 passenger service transactions per year | $150 total, payable annually |

| 401 - 600 passenger service transactions per year | $400 total, payable annually |

| 600 + passenger service transactions per year | $1.20 per passenger service transaction, calculated and paid monthly |

How do I count booked passenger service transactions for levy purposes?

Booking service providers must pay a $1.20 levy for each passenger service transaction provided in an assessment period. For most booking service providers an assessment period is one month, unless you carry out fewer than 600 passenger service transactions, which means an annual assessment is required.

In determining how many passenger service transactions have been completed in an assessment period, it would be reasonable to expect to have to pay a $1.20 levy for each booked trip undertaken. The law makes it clear that where a booking is cancelled, the levy is not payable.

The following examples illustrate how you may calculate the number of passenger service transactions you have done. These examples do not cover all possible scenarios and you may need to seek independent advice.

- If a single booking is taken to transport more than two or more passengers from a single pick up point, then a $1.20 levy is payable for that trip, even if the passengers are transported to different destinations, such as friends booking a shared taxi to their respective homes following a night out.

- A single event, such as a phone call or email, may include multiple bookings and therefore multiple passenger service transactions and the levy would need to be paid for each separate transaction. For example:

- A hotel makes two bookings in the same phone call for two separate groups to be transported from the hotel to the White Bay cruise terminal. In this case, two $1.20 levy charges should be made, even though transport is being provided from a common pick up point to a common destination at the same time.

- A limousine company takes bookings from a regular client who emails through a list of advance bookings for 20 separate trips over several months. In this case, twenty $1.20 levy charges should be made.

- Similarly, if a client is booking a return trip to and from the airport, then two $1.20 levy charges should be made, regardless of whether the return trip is on the same or different days.

- If a booking is for a round trip, including if there are a number of stops along the way, and the vehicle is not available for hire to provide passenger services to anyone else during that time, then one $1.20 levy is payable for the whole trip. An example might be someone booking a taxi or hire vehicle to run errands and then return home.

- If a booking is made on a time basis, for example for an hour, half a day or for a whole day, such that the vehicle is not available for hire to anyone else, then one $1.20 levy is payable for that booking. An example of this would be a company booking a limousine for use by business executives for their exclusive use to travel from the airport to various meetings throughout the day.

- However, if a booking on a time basis spans multiple days (whether or not consecutive), then the pick up on each day of the booking constitutes a separate passenger service transaction, and $1.20 needs to be paid for each day. This is because it would be possible to cancel individual days.

In all of the examples above, if more than one vehicle is dispatched to fulfil the passenger service, then the $1.20 levy is payable for each vehicle noting that those vehicles are not available for any other hire during that period of time.

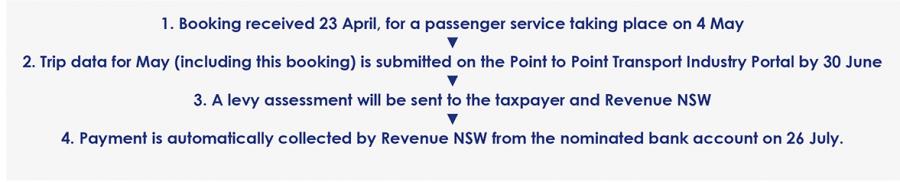

When do I count a passenger service transaction for an advance booking?

The passenger service transaction should be included in your return for the month in which the trip occurs, rather than when the booking may have been made. For example, if you take a booking on 23 April for a passenger service that will take place on 4 May, you should include this passenger service transaction in your return for the month of May (which you would be making in June).

What happens if I don’t pay in full?

Revenue NSW will be in contact to collect any overdue amount if you do not pay in full.

Payment of the levy is a condition of authorisation, and failure to comply may result in the Commissioner taking steps to vary, suspend or cancel your authorisation.

If this happens, you will be prohibited from providing taxi or booking services until your authorisation is reinstated. Fines of up to $110,000 may apply for a person who provides services without an authorisation. A body corporate convicted of providing a taxi or booking service without an authorisation for a second time may be liable for fines of up to $10,000,000. You will still be required to pay the outstanding debt, even if your authorisation has been cancelled.

What if I disagree with an assessment

There are four circumstances in which you can lodge an objection with the Commissioner:

- A mistake was made in your return which resulted in a higher assessed liability.

- If you receive an estimated assessment and you can demonstrate that the actual number of passenger service transactions is lower than the estimated assessment.

- A third party such as a driver, affiliated provider or other person collected the levy amount on your behalf, but has not paid the levy amount (or as otherwise agreed), and you have taken all reasonable steps to recover that amount such as providing written instructions and reminders relating to the collection and remitting of levy amounts, or have the amount paid.

- You gave a third party such as a driver, affiliated provider or other person reasonable directions about collecting the levy. The levy amount was not collected by the person as you directed, and you took all reasonable steps to recover the amount such as providing written instructions and reminders relating to the collection and remitting of levy amounts, or have the amount paid.

You may not make an objection on the grounds of a third party failing to pass on the levy amount to you more than once in relation to the same person.

You must provide written evidence to support your objection. Further information on lodging an objection will be contained in your notice of assessment.

You must continue to pay any outstanding levy amounts and any new assessments while your objection is being considered.

If you remain dissatisfied with the outcome of your objection, you can appeal to the NSW Civil and Administrative Tribunal or the Supreme Court of NSW for further review.

Unless the Commissioner is satisfied that there are special circumstances, you must lodge your objection within 30 days of the initial assessment if a mistake was made in your return or within 60 days if the issue is with third party collection.

Some examples of special circumstances include:

- A serious illness or other personal emergency affecting the taxpayer or person(s) responsible for returns for the taxpayer.

- A failure of computing or other systems, including loss of data, affecting the taxpayer’s ability to make the objection.

- An unforeseen occurrence or circumstance outside of the taxpayer's control.

What happens if I take a booking referral from another booking service provider?

If a booking service is referred, the booking service provider who ultimately provides the passenger service, or communicates the booking to the driver, is liable to pay the levy.

Each booking service provider will need to maintain passenger service transaction records that accurately reflect the referral.